3 Key Automation Strategies You Should Consider to Mitigate Fraud Risk in Your Accounts Receivables

Spotlight on Accounts Receivable fraud: A threat businesses can no longer afford to ignore

Fraud is the most common crime committed in the UK – and it’s on the rise. The amount of fraud in the UK more than doubled in 2023 to £2.3billion and the number of reported cases was up by 18% to a three-year high1. Growing economic instability, tightening regulations and the fight against corruption has catapulted risk management and fraud prevention to the top of the to-do list for AR and Finance departments.

The O2C cycle covers most transactions and interactions with customers, and as such is a business process that is at high risk of attempted fraud, both internally and externally.

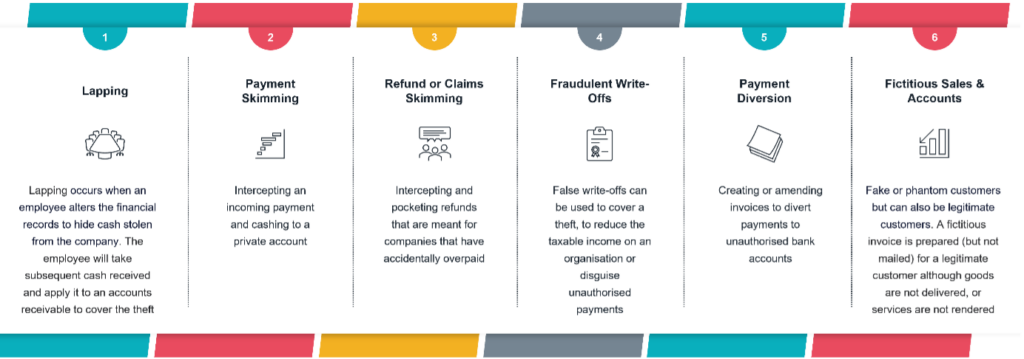

6 AR fraud schemes to watch out for:

Are you on top of your AR fraud risk?

Making risk management a priority and optimising processes by implementing effective organisational practices and strategies can help businesses protect themselves from these threats.

Here are 3 automation strategies that tackle fraudulent activities and payment anomalies.

1. Digitalise customer onboarding

Today, onboarding a customer not only requires estimating their solvency, it requires rigorous background-checks and anomaly screenings to ensure the integrity of your business network and customer portfolio. Businesses need to check potential and existing customers against various compliance checklists to ensure they adhere to government regulations, industry standards and internal processes. With automation, compliance monitoring data can be factored into your onboarding and customer account review processes alongside credit bureau and internal data providing a 360-degree view of all relevant information.

O2C automation solutions offer fully digitised credit applications. Fully customisable credit application templates and automated approval workflows ensure all data is captured, validated and retained. Access, approval and user permissions are granted according to tightly secured and configured frameworks established by a company.

This ensures that at every stage of the process — from creating customer records to approving credit limits — each person has access to the information needed to carry out the assigned tasks and all actions and decisions are recorded and auditable.

2. Adopt e-invoicing and centralise payments

By configuring e-invoicing rules and approval channels, every document can be directed to the correct person, with an auditable trail.

Invoices can be subject to validation based on a variety of optional criteria before sending to a customer which can help mitigate the risk of falsification of documents.

Proof of delivery and purchase order are recorded centrally which reduces risk of invoices being raised against fictitious sales and any anomalies or missing documentation are immediately flagged for attention.

Centralising payments via an e-invoicing portal gives instant visibility and traceability of transactions.

3. Automate Your Claims and Deductions Process

Automation helps mitigate against payment skimming and fraudulent write-offs as any short payments and deductions are matched using AI to the applicable original documents. Anomalies get flagged automatically making patterns of mismatched claims quicker and easier to spot!

Automating cash application adds a further way to detect anomalies with an automatic verification layer added to the reconciliation of documents and information. As an example, an alert is sent if a customer’s bank details on a remittance do not match the information entered in the database.

Automating the O2C cycle can also involve setting up indicators and measurement tools that provide real-time, high-visibility monitoring of cashflow changes, related forecasts, activity variations and any other data linked to O2C cycle performance.

This also enables managers in finance, procurement and accounts payable to detect any weaknesses in the process that may lead to cash flow disruption. They can also then formulate effective strategies as well as find ways to use all this information to better determine and implement operable drivers.

By being able to track and record every action, O2C automation solutions offer visibility and accountability.

When a business is audited, it must be able to recover and provide records of all actions that have been taken, proving that it complied with all legally required procedures and that it has thoroughly carried out its due diligence with service providers.

Internal controls underpin your accounts receivable process and provide continuous protection from fraud

Whilst automation technology does not stop fraud, it does introduce workflows and internal controls that deter fraudulent activity and ensure due diligence. Increased visibility and traceability of transactions make it faster and easier to spot anomalies in AR activity.

It’s clear in today’s business environment no organisation can afford to neglect the risk of compliance, fraud and crime. With a combination of improvements across the business, IT and company culture business can ensure business integrity to mitigate and deter fraud.

Stay a step ahead

Esker are proud partners of the @O2CLab Community Fraud Prevention Network. Aimed at the B2B community, the forum aims to assist in the prevention and/or reduction in their losses caused by criminal activity and provide members with the practical tools and solutions they need to meet the challenges of the current business environment.

Want to ensure fraud prevention measures stay a step ahead? The Forum meets quarterly in-person and there is a facility to join the meeting virtually via Zoom. Come along to your first meeting for free and become a part of this growing community of credit professionals. Contact O2CLab Community for more information. https://www.forumsinternational.co.uk/contact/

April 5th, 2024